All Categories

Featured

A financial investment lorry, such as a fund, would certainly need to identify that you qualify as a certified financier - best investments for accredited investors. To do this, they would certainly ask you to fill up out a survey and potentially supply particular documents, such as monetary declarations, credit scores reports. new rules for accredited investors, or income tax return. The benefits of being an accredited investor include accessibility to unique financial investment possibilities not available to non-accredited capitalists, high returns, and enhanced diversification in your portfolio.

In particular regions, non-accredited investors likewise deserve to rescission (private investor leads). What this indicates is that if a financier decides they wish to take out their money early, they can declare they were a non-accredited financier the whole time and receive their refund. However, it's never a good idea to offer falsified papers, such as phony income tax return or monetary declarations to a financial investment vehicle simply to spend, and this might bring lawful problem for you down the line - series 65 accredited investor.

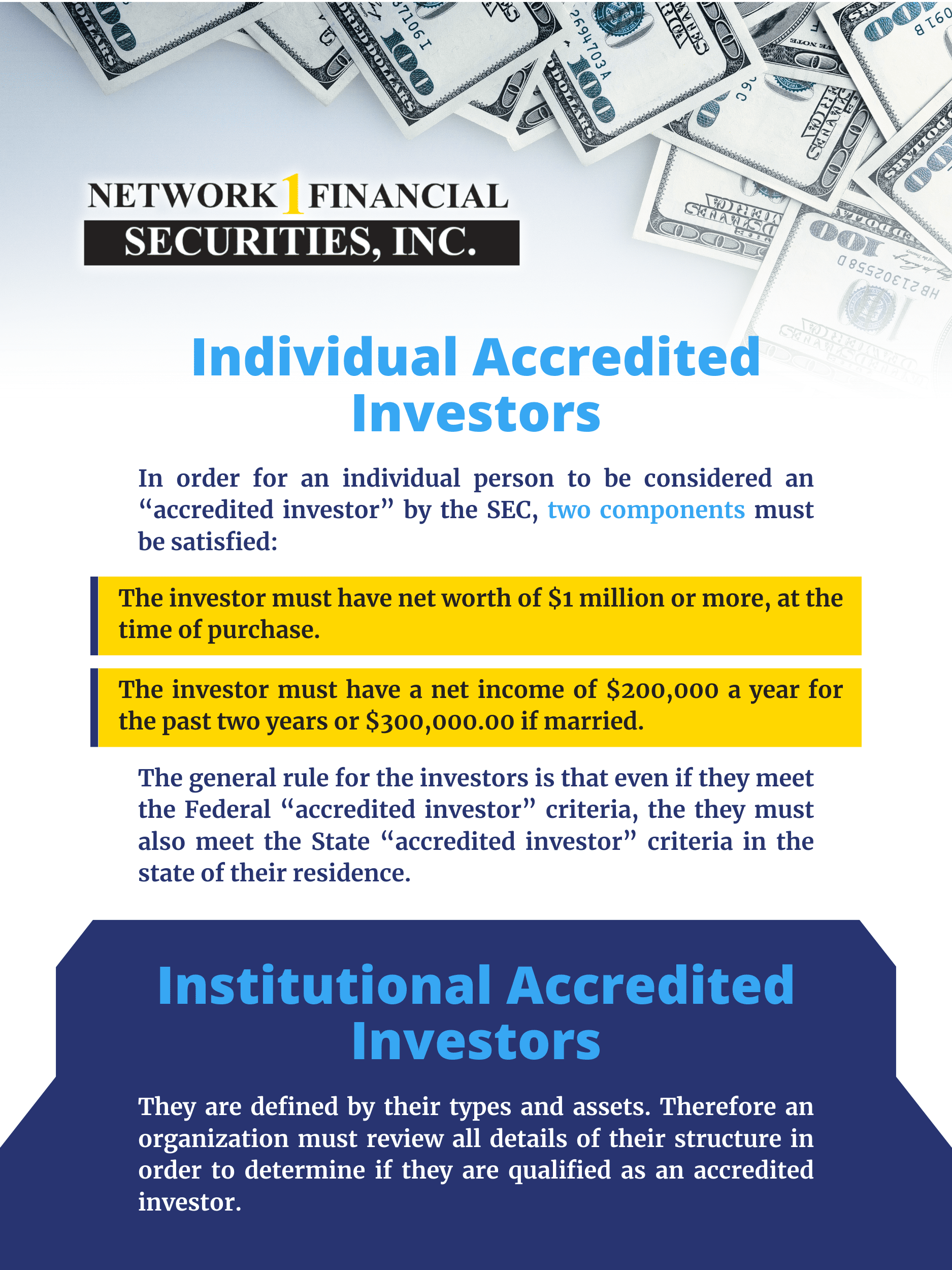

That being said, each offer or each fund might have its very own restrictions and caps on investment amounts that they will certainly approve from a financier. Recognized investors are those that meet certain demands pertaining to earnings, credentials, or internet well worth.

Latest Posts

Tax Lien Certificates Investing

Property Tax Foreclosure New York State

List Of Tax Properties For Sale