All Categories

Featured

Table of Contents

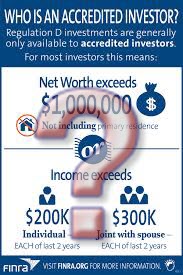

Investments include risk; Equitybee Securities, participant FINRA Accredited financiers are the most professional investors in the business. To certify, you'll need to fulfill several requirements in earnings, web worth, possession size, governance standing, or specialist experience. As a recognized investor, you have access to a lot more intricate and advanced kinds of securities.

Enjoy accessibility to these different financial investment chances as an approved financier. Approved financiers commonly have a revenue of over $200,000 individually or $300,000 jointly with a spouse in each of the last two years.

Dependable Exclusive Deals For Accredited Investors

To gain, you just need to join, purchase a note offering, and await its maturation. It's a great source of passive revenue as you do not require to check it very closely and it has a short holding duration. Great yearly returns range between 15% and 24% for this possession class.

Prospective for high returnsShort holding period Resources in danger if the customer defaults AssetsContemporary ArtMinimum Financial investment$15,000 Target Holding Period3-10 Years Masterworks is a platform that securitizes blue-chip art work for investments. It acquires an artwork via public auction, after that it registers that possession as an LLC. Beginning at $15,000, you can buy this low-risk property class.

Get when it's supplied, and after that you obtain pro-rated gains when Masterworks sells the art work. Although the target duration is 3-10 years, when the art work gets to the wanted worth, it can be marketed earlier. On its site, the finest recognition of an artwork was a massive 788.9%, and it was only held for 29 days.

Its minimum begins at $10,000. Yieldstreet has the widest offering across different investment platforms, so the quantity you can earn and its holding duration differ. There are products that you can hold for as short as 3 months and as long as 5 years. Typically, you can make with rewards and share gratitude gradually.

Esteemed Accredited Investor Platforms

One of the drawbacks here is the lower annual return price compared to specialized platforms. Its monitoring fee generally ranges from 1% - 4% each year. venture capital for accredited investors.

In addition, it receives rent revenue from the farmers during the holding period. As a capitalist, you can make in two methods: Obtain dividends or cash money return every December from the rental fee paid by renter farmers.

Streamlined Accredited Investor Investment Funds

Farmland as a property has historically reduced volatility, which makes this a fantastic option for risk-averse investors. That being said, all financial investments still bring a specific level of risk.

Furthermore, there's a 5% fee upon the sale of the whole home. Stable asset Annual cash money return AssetsCommercial Real EstateMinimum InvestmentMarketplace/C-REIT: $25,000; Thematic Funds: $100,000+Target Holding PeriodVaries; 3 - ten years CrowdStreet is an industrial property financial investment platform. It spends in various bargains such as multifamily, self-storage, and industrial properties.

Handled fund by CrowdStreet Advisors, which automatically expands your investment across various residential properties. accredited investor financial growth opportunities. When you buy a CrowdStreet offering, you can get both a money yield and pro-rated gains at the end of the holding duration. The minimal financial investment can differ, but it generally starts at $25,000 for market offerings and C-REIT

While some possessions may return 88% in 0 (passive income for accredited investors).6 years, some possessions shed their value 100%. In the background of CrowdStreet, more than 10 properties have adverse 100% returns.

Personalized Passive Income For Accredited Investors

While you won't obtain ownership here, you can possibly get a share of the profit once the start-up efficiently does an exit event, like an IPO or M&A. Lots of great companies remain personal and, as a result, usually hard to reach to financiers. At Equitybee, you can money the supply options of employees at Red stripe, Reddit, and Starlink.

The minimum financial investment is $10,000. This system can potentially offer you huge returns, you can likewise lose your entire money if the start-up stops working.

When it's time to exercise the option during an IPO or M&A, they can benefit from the possible rise of the share cost by having a contract that allows them to purchase it at a discount (accredited investor high return investments). Accessibility Numerous Start-ups at Past Valuations Diversify Your Portfolio with High Growth Start-ups Purchase a Previously Hard To Reach Asset Course Based on schedule

Alpine Note is a temporary note that gives you reasonably high returns in a short period. It can either be 3, 6, or 9 months long and has a set APY of 6% to 7.4%. It also offers the Ascent Earnings Fund, which buys CRE-related elderly financial obligation car loans. Historically, this earnings fund has outperformed the Yieldstreet Alternative Revenue Fund (previously called Yieldstreet Prism Fund) and PIMCO Income Fund.

Exceptional Accredited Investor Real Estate Investment Networks

And also, they no longer publish the historic efficiency of each fund. Short-term note with high returns Absence of transparency Complex costs framework You can certify as a recognized capitalist utilizing two criteria: economic and specialist abilities.

There's no "exam" that provides an accreditor capitalist permit. Among one of the most important points for an approved investor is to secure their capital and expand it at the exact same time, so we chose possessions that can match such various risk cravings. Modern spending platforms, specifically those that provide alternative properties, can be fairly unpredictable.

To ensure that accredited capitalists will be able to form an extensive and diverse portfolio, we selected platforms that can fulfill each liquidity need from temporary to long-lasting holdings. There are numerous financial investment opportunities accredited financiers can check out. Some are riskier than others, and it would depend on your risk cravings whether you 'd go for it or not.

Accredited financiers can diversify their financial investment profiles by accessing a more comprehensive array of asset courses and investment techniques. This diversification can aid alleviate risk and boost their general portfolio efficiency (by preventing a high drawdown portion) by lowering the dependence on any kind of solitary investment or market field. Accredited investors frequently have the chance to attach and team up with various other like-minded investors, sector specialists, and business owners.

Latest Posts

Tax Lien Certificates Investing

Property Tax Foreclosure New York State

List Of Tax Properties For Sale